Unlock working capital

Unlock additional working capital for both you and your suppliers without taking out a bank loan and / or other expensive factoring solutions.

Unlock working capital for both you and your suppliers.

Is your organisation sometimes in the position where investments are needed for growth, innovation, quality or perhaps sustainability? There is a good chance that Supply Chain Finance is the solution. You unlock extra working capital at a lower cost than a bank loan and at the same time bind your suppliers better to you by making your payment term more flexible.

Investments are often expensive initiatives that require a lot of working capital. Capital that is often stuck in your business operations and therefore can’t be used for other activities. To obtain extra working capital, loans are taken out or strategic choices are made to unilaterally extend the payment terms for example.

In the current economic situation, the unilateral extension of payment terms can have negative consequences for your organisation, because the demand is greater than the supply. Suppliers have become more selective in choosing the right business partners.

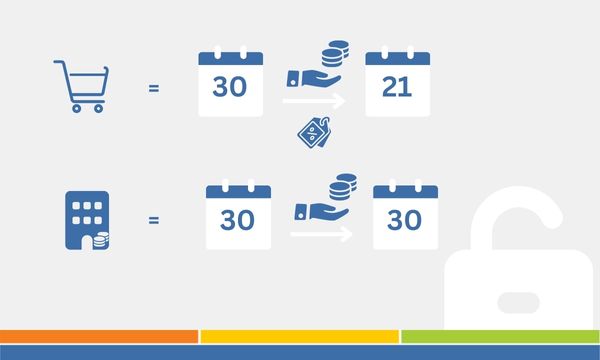

Use our free to use NCN Capital, cloud based platform to give your suppliers the opportunity to choose a date on which the invoice will be paid.

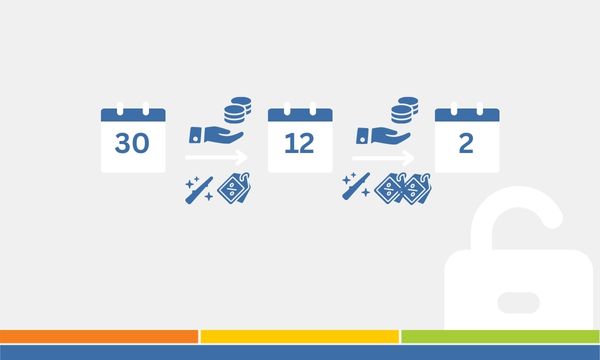

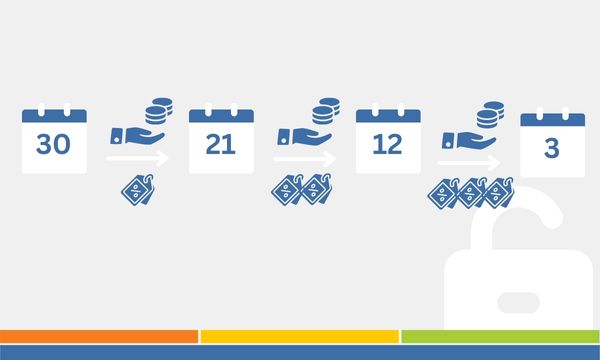

Supply Chain Finance is the Win-Win solution to unlock extra working capital by extending the payment terms but at the same time giving the supplier the possibility of a quick payment after invoice approval.

Unlock additional working capital for both you and your suppliers without taking out a bank loan and / or other expensive factoring solutions.

We connect to all ERP systems so that we can fully automate this payment process, using our inhouse API connections.

The cooperation is more efficient, and your suppliers will have more space and willingness to proactively contribution to the objectives of your organisation.

In a purchasing market where the need is bigger than the supplier can handle, you bind suppliers who are important to your core business of your organisation.

Contribute to your CSR objectives and improve your brand image, both with suppliers, stakeholders and external parties.

Work with a team of experts with over 20 years experience to help get you up and running with NCN Capital.